Wise home buyer, happy owner

Choosing a home is a significant decision where every step counts. Beyond price and space, what matters is knowing this is where you really belong.

We’ve created a guide to help you through every step of the journey – from choosing the perfect location to buying, furnishing, and later maintaining your home.

Here you’ll find practical advice and insights to help you make confident, informed decisions, ensuring that your new home will be a place where you feel at ease today and for years to come.

Why reserve a home?

Reserving a home means choosing a home that suits you and temporarily ‘locking it in’, so that no one else can buy it at the same time.

At Merko, you can reserve a home for two weeks free of charge. This gives you time to calmly reflect on things, engage with your bank, and make all the necessary preparations for buying a home.

During the reservation period, you can rest assured that your chosen home is reserved exclusively for you.

How to reserve a Merko home?

You can reserve a Merko home via the My Merko Home Portal.

Select your perfect home and submit a reservation. The reservation is valid for up to two weeks from the moment the sales manager confirms it and notifies you.

If you require additional time, simply coordinate with the sales manager to extend the reservation period. If you wish, you can cancel the reservation yourself on the My Merko Home Portal.

What can you do in My Merko?

What can you do in My Merko?

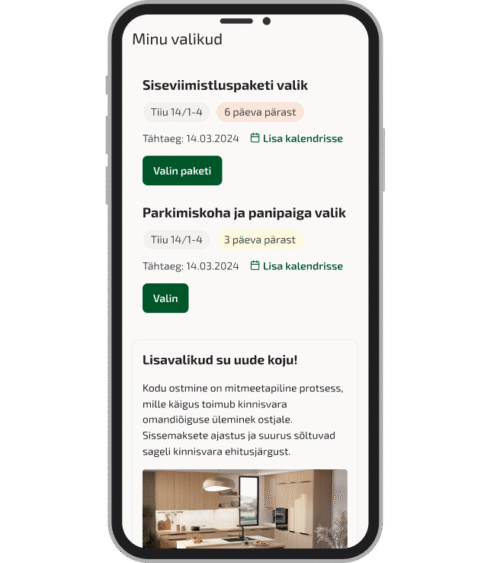

- My Merko is a tailored space for homebuyers, where everything you need is in one place. You can easily explore and compare homes, save your favourites, and share them with loved ones.

- Once you have found a suitable home, you can reserve it through the portal and, if necessary, connect directly with the sales manager.

- You can also choose a parking space and storage room, and track the progress of your home purchase every step of the way.

- If you have any questions, you’ll conveniently find answers on the portal – no need for emails or phone calls.

Buying a

home using a bank loan

Buying a

home using a bank loan

Starting early is essential if you are planning to purchase a home using a bank loan.

- Reach out to banks for loan offers to determine your borrowing potential and the conditions under which you can purchase a home. This makes decision-making easier and gives you the confidence that you’re making a choice within your means.

- The bank will take into account your income, existing financial commitments, and down payment – typically a minimum of 10% of the price of the home. Once you’ve found a suitable offer, the purchasing process can begin.

- Our sales managers will help guide you through the home-buying process and ensure that you have the documents required by the bank or notary. My Merko is also helpful, as it allows you to monitor the entire process, communicate directly with the sales manager, and consolidate all the steps involved in buying a home in one single place.

Buying a home and becoming a homeowner

Buying a home involves a series of steps, where the ownership of the property is transferred to the buyer. The timing and amount of down payments often depend on the property’s stage of construction.

A contract under the law of obligations and a loan agreement with the bank

Real right contract and becoming the owner of the home

What is included in the apartment price and what is not?

The apartment price includes:

- a finished apartment that meets the project specifications and interior finishing agreements

- bathroom furniture along with sanitary wares

- fee for the establishment of utility networks (electricity, water, and sewerage lines) and connections to them

The apartment price does not include:

- notary fees and state fees related to the conclusion of the sales contract

- fees for connecting to telephone, data communication, cable television, and security alarm services